From Spreadsheets to Data Visualizations: Build an Interactive Financial Dashboard with Power BI

Power BI

Introduction

In the past, analyzing financial data was a challenging task. Spreadsheets, with their endless rows and columns, were the primary tool, making it time-consuming and requiring significant financial expertise to extract valuable insights. However, the advent of Power BI has revolutionized this process. Power BI is a cutting-edge business intelligence tool that has transformed how we handle financial data. The Power BI Financial Dashboard converts complex financial information into an intuitive visual representation, highlighting patterns, trends, and key metrics in a single glance. This allows users to quickly and easily understand their financial status with just a click.

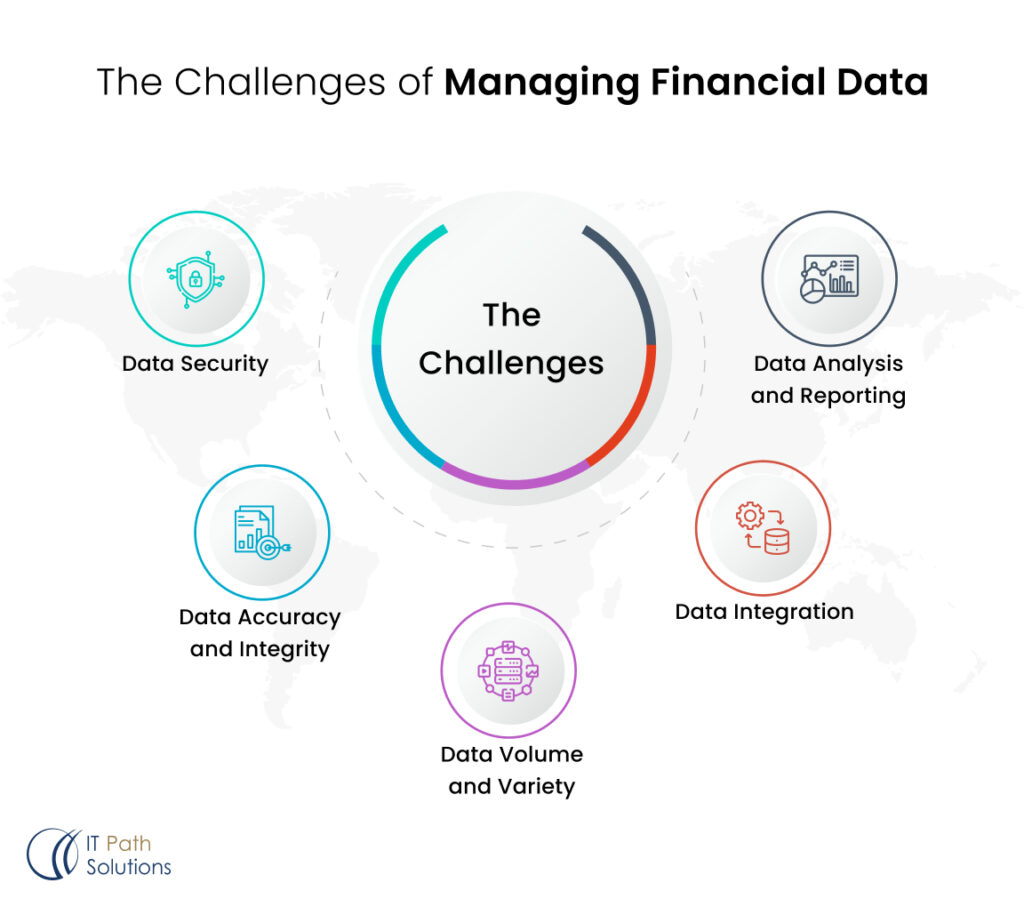

Challenge of Managing Financial Data

Challenge of Managing Financial Data

Data Security:

Protecting financial data, which could damage your reputation and bring about breaches, becomes your responsibility. In such cases the cost can be catastrophic like identity theft or complete company failure.

Data Accuracy and Integrity:

Assure proper financial statement accuracy for anti-fraud purposes and effective decision-making. Consistency and uniformity are vital for the generation of accurate financial wisdom.

Data Volume and Variety:

Oversee multi-source databases such as marketing and consumers. Accurate data collection is highly dependent on efficient control.

Data Integration:

Power BI migration streamlines integrating financial data from diverse sources and formats. No more manual parameter translation – analyze everything in one place.

Data Analysis and Reporting:

Adopt advanced analysis methods and hardware that can generate valuable insights from complex financial data. Uncovering the truth is crucial for the media, which also plays a key role in making executive decisions.

Also Read: Stop Guessing, Start Knowing: Business Intelligence Solutions For Smarter Decisions

How To Build Power BI Financial Dashboard

Gain actionable insights into your finances with a custom Power BI Dashboard for Finance. This interactive tool will show you how to connect your data sources and create compelling Power BI visuals to make informed financial decisions.

Define Your Goals and Gather Data:

Make a point of hearing! Interact with finance users (CFOs, heads of departments) to discover their data necessities and challenges. Upfront goals lend the Financial Dashboard Power BI improved clarity.

Connect to Data Sources:

Visualize your finances from multiple resources such as ERP, cloud accounting. It is up to you to make it secure and keep it up-to-date by setting up automatic updates.

Transform and Clean Data:

And the end comes is to scrub the data! Utilize Power BI Finance Dashboard Query Editor in order to make sure there is data accuracy and to get the credibility of the enterprise through transparent data.

Create Data Models and Visualizations:

The true wonderment is when data imaginations which are really pure are concreted into the charts and the data models. Develop the Power BI Financial Dashboard with conditional formatting and dazzling visuals to make it simple and straight to the point.

Add Interactivity, Formatting and Themes:

Imagery alone is not enough; design matters too. Pay close attention to well-organized layouts, themes, and the placement of filters to guide users smoothly through your financial data without the clutter of poor UI design.

Publish and Share:

Make public your artwork! Release the Power BI Finance Dashboard to Power BI cloud or embed it internally. Plan regular feedback sessions, repeatedly review the changes and update the dashboard with more innovations.

Monitor and Maintain:

Power BI Financial Dashboard facilitates powerful financial dashboard management. User-centered design will get you beyond just Excel-ent and make you elite. Learn to rise above them, to be the data viz!

Power BI Financial Dashboards Examples:

Executive Financial Dashboard:

Imagine how executives could have a single, all-inclusive Power BI Financial Dashboard of all the company’s financial statistics on a real-time basis. Not long before clearing the way to data-boxing and receiving fast reports. In a Power BI Dashboard, you can get real-time insights by just one click away.

Visually Appealing Dashboards:

Some financial questions do not have an easy answer. Therefore, provide a clear definition of the problem and illustrate it using entertaining spreadsheets. Financial Dashboard Power BI modulates an attention-grabbing interface of tables, figures and maps for visualizing your information.

Drill-Down for Deeper Analysis:

See through the figures and discover the hidden facts. The fact of Power BI Finance Dashboard is that users can explore such different specific areas with one simple click is a very beneficial feature of it.

Unified Data Source:

Bring together the information from several platforms, such as ERP, accounting software, and spreadsheets, into a single, integrated picture.

Power BI Financial Dashboard cuts through the complexity and delivers the financial information executives need to make informed choices. Don’t let outdated reporting methods hold you back.

Sales Performance Dashboard:

In today’s statistics-pushed business panorama, income groups need to make knowledgeable choices quickly. A well-designed income overall performance Power BI Accounting Dashboard can offer precious insights into your team’s overall performance, permitting records-driven decision-making and driving higher results.

Sales Revenue:

Track overall income by product, region, or sales rep to find out possible achievements.

Sales Goals:

Ensure that we track progress concerning the stated objectives and assess areas that need improvement.

Pipeline Overview:

Understand your sales pipeline the way you do, from the leads to the deal values.

Customer Acquisition:

Probe into the new user acquisition, customer lifetime value, and churn to find the optimum approach.

Sales Cycle Length:

Measure lead-to-customer time as part of the improvement process to shorten the processes and make the operation more efficient.

Sales Rep Performance:

Rank reps according to three criteria, such as conversion rates, deal sizes, and customer satisfaction.

By incorporating these metrics into your sales performance Power BI Financial Dashboard, you empower your team to make informed decisions, optimize processes, and achieve better outcomes.

Also Read– Top Power BI Project Ideas To Watch Out For in 2024

Expense Management Dashboard:

Power BI Financial Dashboard tool offers you a crystal-clear view of your organization’s spending conduct, permitting you to make informed choices and enhance your bottom line.

Track Total Expenses:

View a full image of your spending across all the departments. Find what could be done to make things better.

Budget vs. Actual:

Identify and compare your actual and planned expenses. Easily see the differences and adjust your course as necessary.

Uncover Spending Patterns:

Analyze trends over the time to understand the place where you spend the most money and where it varies.

Target Top Expense Categories:

Dive into your largest expenditure categories to find every likely area of savings.

Vendor Analysis:

Assess vendor pricing and spot out the areas for negotiation or consolidation.

Monitor Employee Expenses:

Be in line with the company policies and find where it is possible to achieve savings.

Power BI Finance Dashboard gives you the authority over the data to make clear more-informed decisions, implement cost-cutting strategies and reach the financial efficiency you dream of.

Statistics:

Gartner’s data shows that 25% of companies can save by having a system of efficient expense policies. As well as that, The Aberdeen Group conducted research and found out that organizations using sophisticated expense management solutions have about 60 percent higher accuracy in their forecasting run.

Profitability Analysis Dashboard:

Power BI Financial Dashboard is your secret weapon. It helps you create a Profitability Analysis Dashboard that provides valuable insights into your company’s financial situation.

Track Gross Profit Margin:

Investigate the overall and individual product profitability to figure out what your profit comes from.

Monitor Operating Profit Margin:

Get to know non-value-adding cost items and implement value-engineering processes.

Uncover Customer Profitability:

Develop a strategy for acquiring and retaining these segments of high-worth customers by segmentation.

Measure Product Profitability:

Assess the products and place the ones with the highest profit margins on top.

Conduct Cost Analysis:

Explore the depth of your cost structure to search for places of alignment.

Perform Scenario Analysis:

Employ forecasting and sensitivity analysis to investigate possible business circumstances and their implications on earnings.

Statistics:

As the Harvard Business Review’s research shows, the companies that have managed to monitor and manage their profit drivers well can have up to 25% more profit margins than the other companies in the same business. Nevertheless, McKinsey & Company data showed that it is because organizations with the most advanced business analysis, that is, a 60% achievement rate on new product launches and price strategies, were the most successful.

Also Read: Power BI Cost: Ultimate Guide On Power BI Pro vs Premium

Cash Flow Management Dashboard:

Hereby presenting the Power BI Financial Dashboard for Cash Flow Management! This is a powerful tool that shows you your real-time cash flow chart and can enable you to steer your financial situation in the direction you want.

Here’s what you should focus on:

Cash Flow Forecast:

Acquire the instruments that will clarify your projections as they will provide the necessary information for informed decisions and projections.

Cash Burn Rate:

Monitor liquidity to be able to react to the case of shortage of cash sometime in advance.

Days Sales Outstanding (DSO):

Identify weak collection strategies that are associated with delayed ineffective payment turnaround timelines.

Days Payable Outstanding (DPO):

Improve cash flow efficiency by managing the length of time it takes for the payments to be made.

Working Capital:

Implement financial assessment with a short-term period in order to keep abreast of assets and debt.

Cash Conversion Cycle:

The harmonization of procedures to accelerate the processing of all types of returns from investments.

Using these metrics, the Cash Flow Management Power BI Dashboard for Finance will give you instant access to control finances, eliminate risks, and become more flexible in choosing cash flow strategies.

Statistics:

According to Deloitte, business profitability increases sixty percent in relevant cash management operations with developed cash flow doctrines over businesses without structured cash flow management practices. Next, to this, the Aberdeen Group health check research reveals that the organizations with fast cash flow management see an acceleration in the cash-to-cash cycle by up to 30%.

Financial Statement Dashboard:

Executives want to get the financial reports fast and correct. They are the cornerstone of strategic decision making and staying competitive, respectively. Power BI Financial Dashboard by Microsoft is what you need in order to create a multi-featured financial statement dashboard that lets you visualize various aspects of your company in one place.

Income Statement:

Monitor the revenue, expenses, and profit margins so as to spot the fluctuations and improve your costs.

Balance Sheet:

Study the assets, liabilities, and equity to determine your financial condition and solvency.

Cash Flow Statement:

Know the magnitude of your cash receipts and expenditure in order to work through the current financial crisis.

Financial Ratios:

Match your result with the finance industry benchmarks and use key metrics like Debt-to-Equity or ROI to analyze your performance.

Variance Analysis:

Recognize the differences between the planned and the actual results and make use of this information for solving the problems in advance.

Forecasting:

Apply Power BI Financial Dashboard’s predictive abilities to project anticipated future financial trends using historical data and benchmarking other firms.

By integrating these modules, the outcome will be a Power BI Financial Dashboard that gives a complete overview of the financial state of your organization. Statistics: PwC study states that companies that spend money on statement analysis and reports availability can double their profitability rate totally. Besides, the Aberdeen Group’s research revealed a straight connection between those who have advanced financial reporting skills and at least 50% better-estimated financial forecasts.

Financial Prediction Dashboard:

With the use of Power BI Financial Dashboard tool which is powered by advanced functionality, you can build the Power BI Dashboard which is just a combination of high-tech analytics and machine learning to give data-driven insights on the potential financial performance of the organization. Here’s what you should focus on:

Revenue Forecasting:

Use the historical data and market trends to shape a sales and marketing strategy that predicts incoming revenue.

Expense Forecasting:

Planning for upcoming expenses and allocating resources properly are the keys to effective budgeting processes.

Cash Flow Projections:

Plan ahead to gain control over the cash flow to manage the funds and invest based on the expected gains.

Scenario Analysis:

Be ready for different scenarios involving shifts in markets or regulations to evaluate the consequences to financial performance.

Risk Assessment:

Identify and classify the financial risks that may occur and develop strategies for their optimization.

Predictive Modeling:

Apply machine learning algorithms on the basis of which accurate predictive models for metrics such as customer churn and fraud detection are created.

With such features integrated into your Financial Prediction Power BI Financial Dashboard, you will be able to gain insights into where your organization is financially going, thus making your decisions timely and facilitating growth opportunities.

Also Read– Power BI’s Integration with AI and Machine Learning

Accounts Receivable/Payable Dashboard:

The Accounts Receivable/Payable Power BI Financial Dashboard can be a crucial factor to maintaining up-to-date information on your accounts receivable, payments status, and the aging reports, therefore, you can well organize the procedure and boost the cash flow. Here’s what you should focus on:

Accounts Receivable Aging:

Identify customer invoices which are in arrears so that early collection steps can be taken, and this will reduce bad debts.

Accounts Payable Aging:

Attempt to the negative supplier relationship by tracking the creditors’ debts and the dates of payments.

Days Sales Outstanding (DSO):

Cut down the processing time of payments by providing the average time of clients’ payments coverage.

Days Payable Outstanding (DPO):

Have timely cash flow management by making a decision on the time suppliers take to enter settlements.

Customer/Vendor Analysis:

Analyze top accounts to pay or collect from – create separate strategies for top buyers and suppliers with large amounts of orders.

Forecasting:

Apply the Power BI Financial Dashboard forecasting function to anticipate the next accounts receivable and payable realities, in order to devise effective financial planning and efficient cash flow management.

The combination of these metrics into your Accounts Receivable/Payable Financial Dashboard Power BI will, in turn, help you have in-depth, real-time information about your organization’s account status that will be instrumental in making right decisions, as well as optimizing your collection and payment processes in order to keep good cash flow level.

Statistics:

According to the Hackett Group, companies that have fully automated their accounts receivable and payable systems can have a cash-to-cash cycle time that is up to 25% faster and a reduction of up to 50% in past-due payments. Moreover, the Aberdeen research noted that companies that set their billing and payment processes as a top priority had up to 20 percent better customer satisfaction level.

Final Thoughts:

Stop guessing and start thriving. Don’t just manage your finances, master them.

By investing in Power BI consulting services, you can craft custom Power BI Financial Dashboards that:

Shine a light on hidden opportunities: Identify areas for cost savings, improved cash flow, and revenue growth.

Transform data into decisions: Gain real-time insights that empower you to make informed financial choices with confidence.

Boost collaboration: Boost collaboration: Share interactive Power BI Dashboards for Finance across your organization, fostering transparency and data-driven decision-making. By doing so, you’ll empower your team to make informed decisions and drive your business forward.

Healthcare

Healthcare  Education

Education  Real Estate

Real Estate  Logistic

Logistic  Fitness

Fitness  Tourism

Tourism  Travel

Travel  Banking

Banking  Media

Media  E-commerce

E-commerce